December 1, 2020

Lots of Bad News from Social Security

By Richard J. Schillig, CLU, ChFC, LUTCF

By Richard J. Schillig, CLU, ChFC, LUTCF

Independent Insurance and Financial Advisor

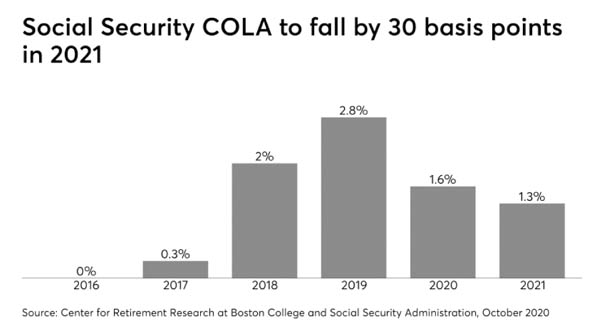

Our good friends at the Social Security Administration has wished us all the best for the Holidays by granting the LOWEST cost of living increase in recent years. According to an article by Tobias Salinger, Senior Editor for Financial Magazine, this will be the lowest increase in 4 years.

See article and chart below:

More than 64 million Social Security beneficiaries will get this lowest cost-of-living adjustment in four years in 2021. Anyone receiving Social Security is a ‘beneficiary.’

Beneficiaries will receive a 1.3% uptick in their benefits payments in January, the Social Security Administration recently announced. The bad news – COLA for next year is 30 basis points lower than in 2020 and less than half the amount in 2019. In another adjustment for next year, the maximum amount of earnings subject to Social Security payroll taxes will rise to $142,800 from $137,700.

Some experts had predicted the 1.3% COLA earlier, with some expecting the uptick to be even lower. Senior advocates often criticize the COLA formula, saying benefits are NOT keeping up with climbing expenses like Medicare Part B premiums. Consider Medicare Part B base premium went from $134 in 2020 to $144 in 2021- that’s a 7.5% increase. Considerably less than 1.3% COLA. Next year’s lower COLA comes as the coronavirus pandemic continues to upend the economy.

Although it’s “modest,” the COLA for 2021 “is needed to help Social Security beneficiaries and their families try to keep up with rising costs,” AARP CEO Jo Ann Jenkins said in a statement. “The guaranteed benefits provided by Social Security and the COLA increase are more crucial than ever as millions of Americans continue to face the one-two punch of the coronavirus’s health and economic consequences.”

Social Security benefits remain the biggest source of retirement income for most Americans and provide 90% or more of the income for one in four older adults, according to AARP. With the coronavirus expected to reduce payroll tax revenue while pushing up disability claims, the program could face automatic cuts to benefits of more than 20% within a decade if Congress doesn’t act. Within a decade is our retirement lifetime. This is serious stuff folks!!

At the same time, advocates for older adults such as the nonpartisan Senior Citizens League are seeking higher COLAs. According to a report by the League released earlier this year, the annual adjustments have only pushed up benefits by 53% in the past 20 years, compared to the cost of 40 routine expenses going up by 99% in that time span, the report states.

The group favors an “emergency” COLA of 3% for 2021 and automatic boosts each year at that level, or the use of other formulas such as the Consumer Price Index for the Elderly.

There has been “an unprecedented series of extremely low” COLAs for Americans receiving benefits in the past 12 years, according to Mary Johnson, a Social Security policy analyst with the League. She added “COLAs have never remained so low, for such an extended period of time, in the history of Social Security.”

The average COLA over the last decade works out to 1.4%, including three years (2009,2010,2015) without any raise — less than half the 3% mean from the previous 10 years, the League’s analysis shows. With automatic 3% raises between 2010 and 2020, beneficiaries would have received an extra $18,000. Congress introduced automatic annual COLAs to the program in 1975.

Tobias Salinger Senior Editor, Financial Planning.

We continue our monthly virtual (non face-to-face) meetings for persons aging into Medicare. These meetings are done over the internet with you on your home computer. Call our office if you wish to participate and learn about the various choices you have with Medicare. These virtual meetings are very helpful in understanding the choices we have as we become eligible for Medicare. Please check our newspaper ads or website for dates and times for our January 2021 virtual meetings.

Richard J. Schillig, CLU, ChFC, LUTCF is an Independent Insurance and Financial Advisor with RJS and Associates, Inc. He can be reached at (563) 332-2200.

Filed Under: Finance, Retirement

Trackback URL: https://www.50pluslife.com/2020/12/01/lots-of-bad-news-from-social-security/trackback/