March 7, 2022

A House Divided

By Richard J. Schillig, CLU, ChFC, LUTCF

Independent Insurance and Financial Advisor

The latest research suggests that divorce rates in the U.S. have been falling in recent decades. Still, many people face the difficult crossroads that comes when their marriage ends.1

Getting a divorce is a painful, emotional process. Don’t be in such a hurry to reach a settlement that you make poor decisions that can have life-long consequences. If divorce is a possibility, here are a few financial ideas that may help you prepare.

The most important task you can do is getting your finances organized. Identify all your assets and make copies of important financial papers, such as deeds, tax returns, and investment records. When it comes to dividing up your assets, consider mediation as a low-cost alternative to litigation. Most states have equitable-distribution laws that require shared assets to be divided 50/50 anyway. When a divorce becomes contentious, attorney’s fees can accumulate.

From a financial perspective, divorce means taking all the income previously used to run one household and stretching it out over two residences, two utility bills, two grocery lists, etc. There are other hidden costs as well, such as counseling for you or your children. Divorces also may require incurring one-time fees, such as a security deposit on a rental property, moving costs, or increased child-care.

Finally, dividing assets may sound simple but it can be quite complex. The forced sale of a home or investment portfolio may have tax consequences. Potential tax liability also can make two seemingly equal assets have varying net values. Additionally, when pulling apart a portfolio, it makes sense to consider how each asset will suit the prospective recipient in terms of risk tolerance and liquidity.

Remember, the information in this article is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. During a divorce, many factors are competing for attention. By understanding a few key concepts, you may be able to avoid making costly financial mistakes.

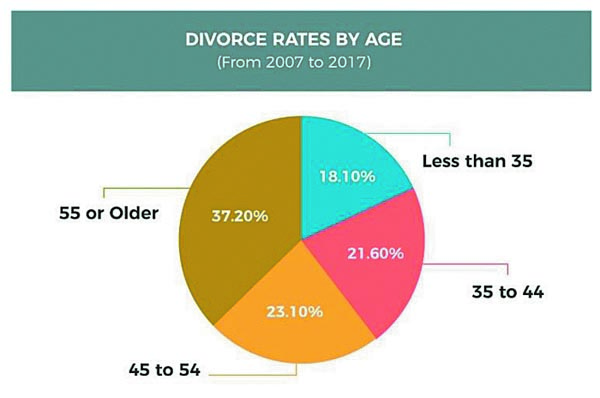

Chart Source: Familyinequality.com, 2019

1. The Wall Street Journal, 2019 The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite is not affiliated with the named broker-dealer, state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information and should not be considered a solicitation for the purchase or sale of any security. Copyright 2020 FMG Suite. During the month of March, we continue our virtual Community Meetings. Tuesday March 22 and Thursday March 24 are the days scheduled for these meetings. On Tuesday March 22. Craig reviews the basics of Medicare then focuses on the Medicare Supplement Plans and Prescription Drug Plans available in these Medicare Regions. On Thursday March 24 Craig again reviews the basics of Medicare then focuses on the alternative to Original Medicare and that is the Medicare Advantage Plans and he focuses on what we believe is the more competitive of the Advantage Plans in these Medicare Regions and that is United Healthcare’s AARP Medicare Advantage Plan. Both these meetings are offered virtually from the privacy of your own home with your laptop or desktop computer. Call Craig to arrange your participation 563.332.2200.