March 31, 2016

What’s an RMD?

By Richard J. Schillig, CLU, ChFC, LUTCF

By Richard J. Schillig, CLU, ChFC, LUTCF

Independent Insurance and Financial Advisor

During this tax season, the topic of the Required Minimum distribution (RMDs) is very prevalent. Our experience with clients is often this additional tax is totally forgotten until we approach that magic age of 70 ½. RMDs are amounts the federal government requires us to withdraw annually from traditional IRAs and employer-sponsored retirement plans after you reach age 70 ½. We can always withdraw more than the minimum amount from your IRA or plan in any year, but if you withdraw less than the required minimum you will be subject to a federal tax penalty. In addition to IRAs all other qualified retirement plans are subject to these rules. Traditional IRAs, Simple IRAs, 403b, 457 plans, 401K plans are all subject to these distribution rules. Uncle Sam wants to get tax money that has enjoyed the deferral benefit all these years.

The RMD rules are calculated to spread out the distribution of your entire IRA or retirement plan over your lifetime. The RMD rules are to ensure taxpayers don’t just accumulate retirement accounts on a continued tax deferred basis. RMDs generally have the effect of producing taxable income during your lifetime. Again the rules are designed to make sure money that remains in tax deferred plans is paid out and subject to income tax.

Your first required distribution is for the year you reach age 70 ½ . However you have some flexibility as to when you actually have to take this first-year distribution. You may take it during the year you reach age 70 ½ OR you can delay it until April 1 of the following year. Since this first distribution generally must be taken no later than April 1 following the year you reach age 70 ½, this April 1 date is known as your required beginning date. Required distributions for subsequent years must be taken no later than December 31 of each calendar year until you die or your balance is reduced to zero. This means that if you opt to delay your first distribution until April 1 of the following year, you will be required to take two distributions during that year – your first year’s required distribution and your second year’s required distribution. For example: You have a traditional IRA. Your 70th birthday is December 2, 2016 so you will reach age 70 ½ in 2017. You may take your first RMD during 2016 OR you can delay it until April 1 2017. If you choose to delay your first distribution until 2017, you will have to take two RMDs during 2017 – one for 2016 & one for 2017. This is because your RMD for 2017 cannot be delayed until the following year.

The amount of the RMD is calculated by dividing your traditional IRA or retirement plan account balance by a life expectancy factor specified in IRS tables. Your account

The amount of the RMD is calculated by dividing your traditional IRA or retirement plan account balance by a life expectancy factor specified in IRS tables. Your account

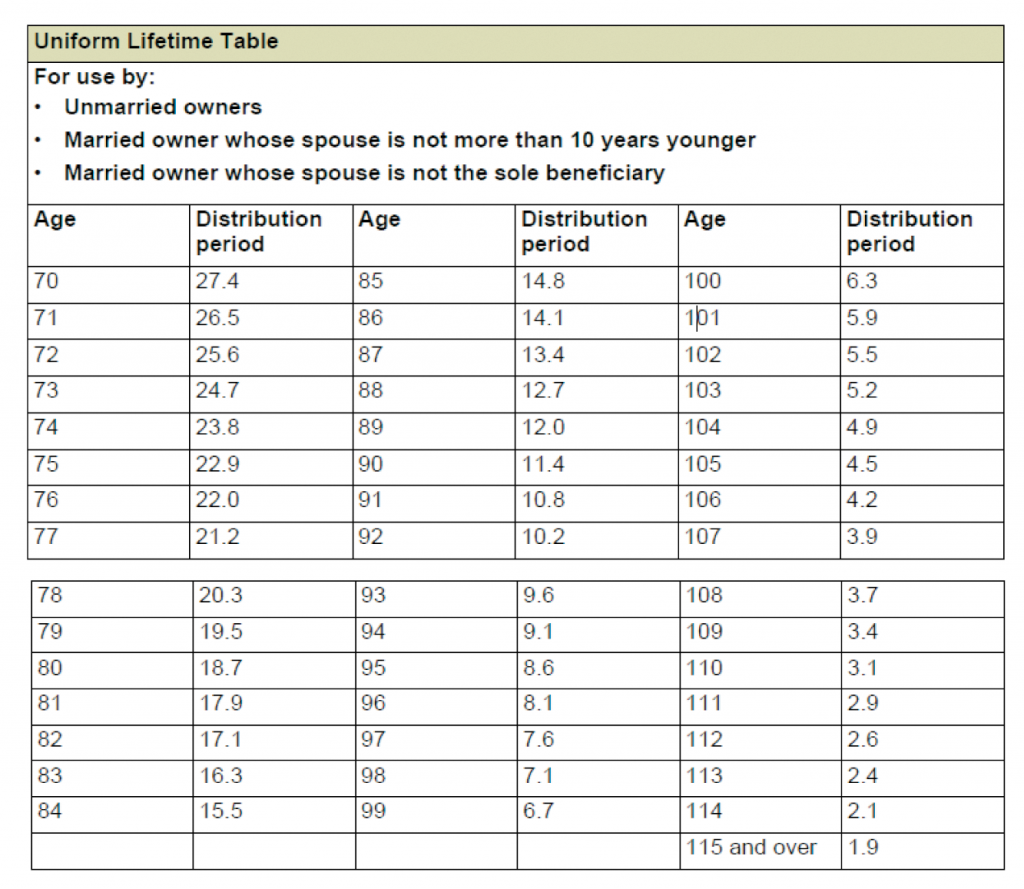

balance is usually calculated as of December 31 of the year preceeding the calendar year for which the distribution is required to be made. For most taxpayers, calculating RMDs is straightforward. For each calendar year, simply divide the account balance as of December 31 of the prior year by your distribution period determined under the Uniform Lifetime table using your attained age inthat calendar year. The life expectancy table is based on the assumption that you have designated a beneficiary who is within 10 years of your age. Special payout periods are used for beneficiaries not within 10 years of your age or for special situations such as inherited IRAs. The Uniform Lifetime Table below is for use by most taxpayers.

One of the issues with RMDs is the potential for depletion of the retirement plan during our lifetimes. Often clients wish to preserve the IRA or retirement plan instead of simply paying the tax intended to deplete the account. Often clients wish to preserve the retirement value for use later in life or for emergencies. RMD rules may prevent this. Use of our creative annuity strategies may assist in helping preserve the account while remaining compliant with the RMD law. Please contact us for details.

Richard J. Schillig, CLU, ChFC, LUTCF is an Independent Insurance and Financial Advisor with RJS and Associates, Inc. He can be reached at (563) 332-2200.

Filed Under: Finance

Trackback URL: https://www.50pluslife.com/2016/03/31/whats-an-rmd/trackback/