February 29, 2016

Traditional IRAs and Roth IRAs

By Richard J. Schillig, CLU, ChFC, LUTCF

By Richard J. Schillig, CLU, ChFC, LUTCF

Independent Insurance and Financial Advisor

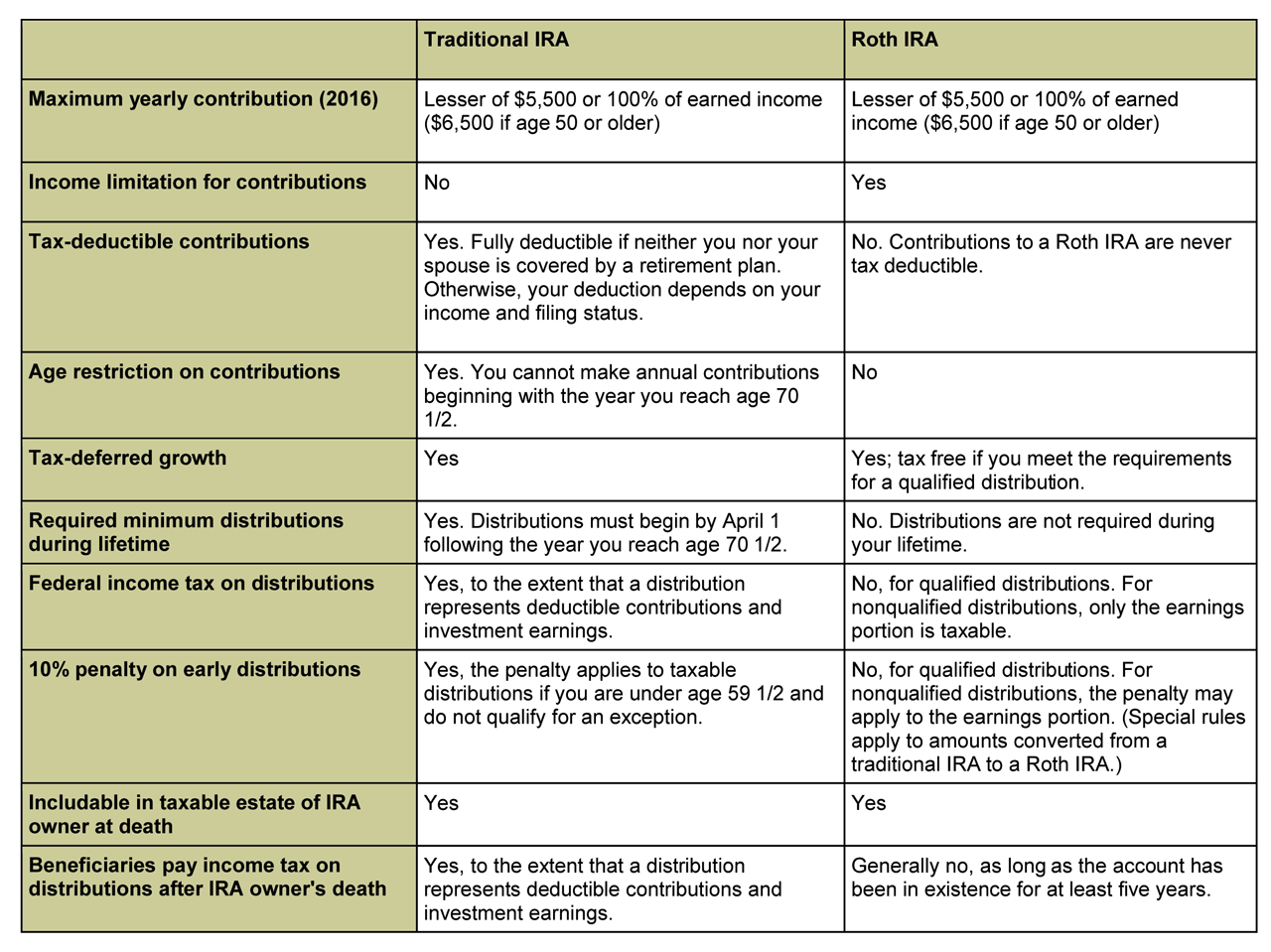

This time of year as clients are completing income tax returns we often receive inquiries on IRAs – especially from tax filers that have a tax amount due at the time of filing. Questions usually focus on eligibility for deduction of IRA contribution. Further questions are on comparing features of the Traditional IRA with Roth IRA. As with all financial products, there are pros and cons of both. The chart below is a simplified comparison of contributing IRA features. Other IRAs – Rollover IRAs, Inherited IRAs etc. will have additional features and eligibility qualifications.

The information presented here is not specific to any individual’s personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances.

These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Richard J. Schillig, CLU, ChFC, LUTCF is an Independent Insurance and Financial Advisor with RJS and Associates, Inc. He can be reached at (563) 332-2200.

Filed Under: Finance, Retirement

Trackback URL: https://www.50pluslife.com/2016/02/29/traditional-iras-and-roth-iras/trackback/