April 27, 2017

Year-round Income Tax Continues

By Richard J. Schillig, CLU, ChFC, LUTCF

By Richard J. Schillig, CLU, ChFC, LUTCF

Independent Insurance and Financial Advisor

April 15th – this year April 18th – is behind us once again! Federal income tax filing is over for another year! We think! But one of the greatest risks to our retirement income is the taxation risk. We often consider taxation especially during income tax season. But after that income tax challenge and frustration is over – our thoughts are “safe for another year.” Wrong thinking readers! Some taxes are not quite as obvious as income tax. Taxation remains a risk year round.

Let’s cite two year-round “hidden” taxes that some folks on Medicare face continually. There is an income-related monthly adjustment amount (IRMAA) that hits some Medicare Beneficiaries in two ways. Everyone on Medicare pays a base premium for Medicare Part B. The base premium is determined during the year in which you initially qualify for Medicare. Base premium for 2017 first time Medicare qualifiers is $134. If collecting Social Security Retirement benefits this base premium is automatically deducted from monthly Social Security Benefits. Medicare folks with higher incomes get dinged twice for additional tax. These tax penalties are applied to both the cost of Medicare Part B premium AND an additional penalty is applied for Medicare Part D.

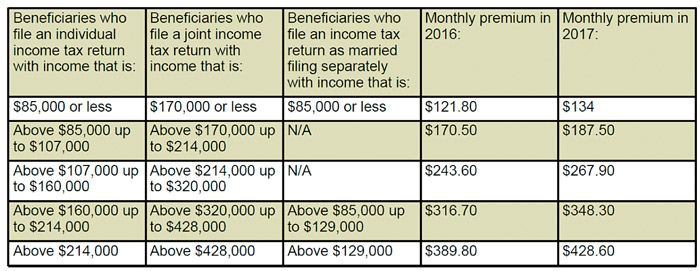

The first penalty is applied to Medicare Part B premium. Note the chart below specifying the additional premium (tax) charge when income falls within these amounts.

The table below shows the Part B premium you’ll pay next year if you’re in this group.

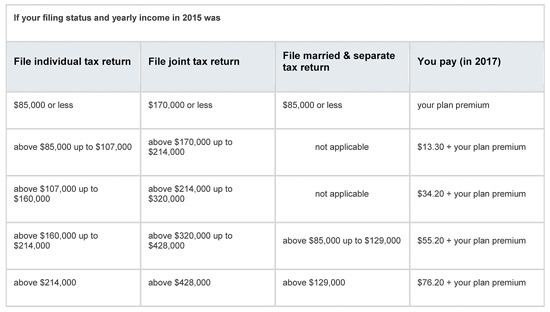

The second penalty tax for Medicare folks with higher incomes is applied to Medicare part D.

The charts below show your estimated prescription drug plan monthly premium based on your income as reported on your IRS tax return from 2 years ago.

It’s incredible to think we pay penalties for having “higher income.” But we really do. Planning becomes even more recommended to assist in minimizing these hidden taxes. Our annuity strategies may succeed in helping to accomplish this. Annuities enjoy special income tax treatment with tax deferral and tax exclusion. Both these special income tax benefits available only for annuities provide opportunities to help minimize taxes. Contact us for additional details.

Richard J. Schillig, CLU, ChFC, LUTCF is an Independent Insurance and Financial Advisor with RJS and Associates, Inc. He can be reached at (563) 332-2200.

Filed Under: Finance, News, Retirement

Trackback URL: https://www.50pluslife.com/2017/04/27/year-round-income-tax-continues/trackback/